The concept of insurance is something that predates history, it has been in existence since time immemorial and we tend to take it for granted. Insurance acts as a safety net to protect a person or his property from a known hazardous event so that if the event occurs, the person is safe or his property is. The way insurance works is the person who wants insurance buys a policy from an insurance company and the person pays premiums to the insurance company. Should the event happen and the person needs assistance, the insurance company will come in and provide the financial aid so as to restore the person or his property to the condition he/she/it would be if the event did not happen. Health insurance uses the same concept, a person pays premiums to a health insurance company so that should the person get sick and require healthcare, the insurance company will come in and pay for the medical expenses.

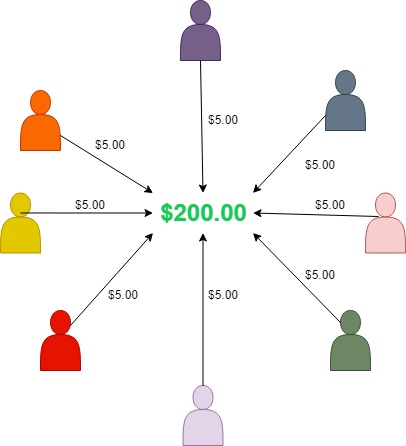

Insurance companies in most cases make money through creating a pool of people that pay premiums for a specific policy in the hopes that not all of them will come and make claims. The insurance company can have a pool of 1000 people paying for health insurance monthly, but out of all of them maybe only 20 can get sick within the month and require medical care. This principle has always been the backbone of insurance and it did not go through any major changes that are worth mentioning. Obviously this is a simplified version of it, but it does the job of explaining insurance for dummies.

Today I want to discuss how we are creating smart contracts that can mimic these operations for health insurance. The smart contracts will implement community-based health insurance and allow people to join a community of likeminded people to protect themselves against unknown future sickness. I will also introduce our platform, Procode, which will give people access to these smart contracts that will be deployed on the blockchain.

Community-Based Health Insurance(CBHI)

As I mentioned that health insurance companies create a pool of people who pay premiums and they expect not all of them to make claims so that they maintain the wellbeing of their finances, community-based health insurance schemes use the same concept. CBHIs allow people to come together and pool contributions of money which they will use to pay for medical expenses should one of the members get sick or has a medical emergency. The only difference is CBHIs are not-for-profit and there is no central company which runs and administers the scheme, this feature makes CBHIs more affordable compared to for-profit insurance with high administration cost.

An example of a CBHI can be a group of taxi drivers in Harare coming together to create a pool to cover road-accident related medical expenses. As you know taxi drivers are always on the road transporting their customers and they face a higher risk of getting into road accidents. Imagine if 500 taxi drivers come together and they start paying $50 monthly premiums into their CBHI pool. The CBHI will be able to raise $25,000 every month, which is enough to cover for medical emergencies should one or more of the taxi drivers be involved in an accident for that month (of which road accidents are not too common). The premium of $50 is way cheaper than what these drivers would have to pay if this was a policy provided by a health insurance company and the drivers can be able to re-distribute any remaining money after the end of a year since the pool is not for profit. Essentially that is the concept of a community-based health insurance.

Using smart contracts

Creating a CBHI has its own problems, one of the biggest problems is administration. Who will administer the pool, who will process claims, who will have access to the pool’s money? Smart contracts address this problem. Smart contracts are like any other traditional contract but instead of being written on paper, they are written as code and deployed on a blockchain like Ethereum or Polygon. In the smart contracts, there are rules, agreements and behaviors as to what the smart contract should do.

An example of a smart contract is a vault. A lot of people struggle with safe keeping money which they do not want to spend and some people use piggy banks to prohibit them from spending that money(which they tend to break before the desired date). You can write a smart contract and the contract would have code to lock your funds until a certain date which you can then receive your money back. All this will be implemented using code and on the immutable blockchain network. There are many advantages to this, for starters smart contracts will always and only behave in the defined way since the code can not be changed once deployed on the blockchain. Smart contracts also remove the idea of trusting someone since they are autonomous and they can execute their code on their own.

This is why smart contracts are suitable for implementing community-based health insurance schemes that have no central administrator. The smart contract can act as an actual contract or a Deed of Trust, receiving, protecting and distributing money from the different members of the CBHI autonomously. And since they will be deployed on the blockchain, no one can change the code or stop the code from running and no one can change the data stored in the smart contract. Let me start describing some of the features of the smart contract.

Contract Metadata

Metadata is the data that describes the contract including the name of the CBHI, monthly premiums, reserve percentages, descriptions of the CBHI, restrictions as to what the CBHI will cover and what it will not cover etc. The metadata is immutable meaning no one can change it when the smart contract is published.

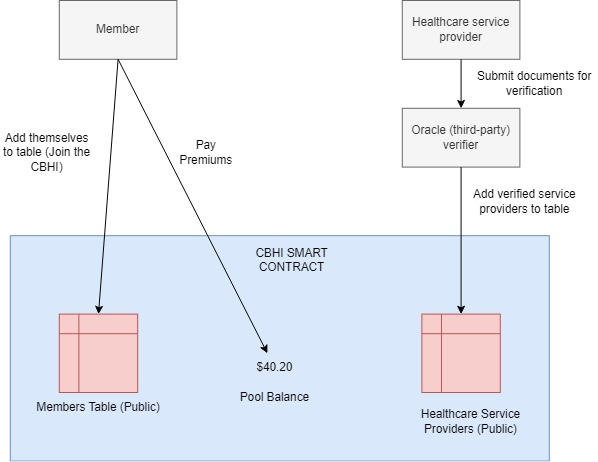

Accepting members

The smart contract should have the ability to accept members into the pool without the need for any third-party or central organization. The smart contract would add the unique address of the person requesting to join the contract in to a public table containing all the members. The public table for members will contain the unique address for every member (members have to remain anonymous for data privacy), the total amount deposited by the member through premiums, total amount of claims made by the member etc. The table is public so that everyone can be able to see and monitor the members joining the pool, the premiums paid by every member and the total claims being made by members.

Pool balance

A public pool balance will be available so that members or anyone who wants to join the CBHI can be able to see how much is locked within the contract and is available for claims. This amount will increase as members pay premiums and decrease when claims are made. The pool balance will also be used to determine and calculate how much money a member can claim based on their claim history.

Premium Payment

Members of the CBHI smart contract should be able to pay premiums on their own without the need for any third-party to process and publish the payment. When a transaction is successful, it should be added to a public ledger for all payments. The public ledger is available publicly so that everyone can see which members have paid their premiums. The smart contract should also be able to remove members that do not pay their premiums into the smart contract in time so that members that pay-up can make claims.

Healthcare providers

The community-based health insurance pool should rely on pre-determined healthcare providers that meet the standards required by the pool. To avoid fraudulent healthcare providers, a third party (or a blockchain Oracle) is used to add verified providers so that criminals can not come and pose as healthcare providers. The verified healthcare providers will be added to a public table with their data including the name of the provider, their address and minimum fees etc. Everyone will be able to see the network of healthcare providers they can use when they need to access health services funded by the CBHI.

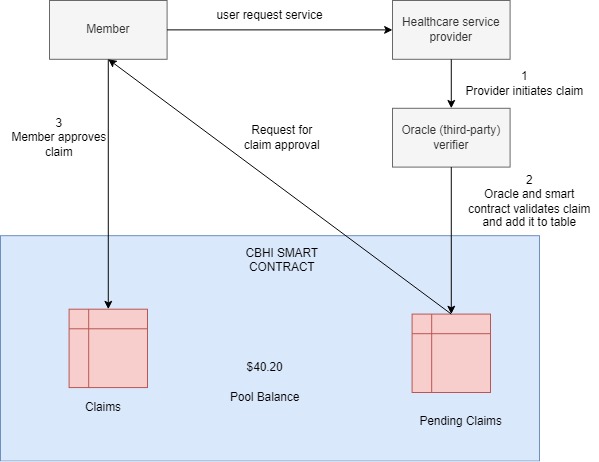

Claims processing

A three-stage claims process should be used to process any claim made by members. Claims are the only way fraudulent members, healthcare providers or criminals can be able to access locked funds in the pool hence certain guardrails have to be put in place to protect the wellbeing of the pool. Only authentic claims should be processed successfully and any fraudulent claims should be rejected before any money is sent to the perpetrators. The first guardrail is that the verified healthcare providers will be compensated directly for their service to a member who is making the claim. This means no direct payment to the member himself hence every claim should be initiated by the healthcare provider as the first step.

The second stage is the validation of the claim and the claim amount using historical claims data for the member in need and the pool balance. The validation stage can only be initiated a third-party validator or blockchain oracle, this is another layer of security. However, the smart contract will be the one doing the validation of the claim and if a claim is valid it is added to a public list of pending claims. The last stage is for the concerned member to approve the claim to make sure the healthcare provider did not initiate the claim without the knowledge of the member. Only the member can approve without the need for any third-party. Once the claim is approved, the smart contract will send the claimed amount to the healthcare provider instantly.

Re-imbursement of remaining funds

If there were less claims made against the pool compared to the pool balance at the end of the lifespan of the CBHI, the remaining balance should be distributed back to the members. This process can be initiated by any member of the pool and the smart contract will automatically send to the members an amount which will be calculated based on the claims history the user made. For example if a member made total claims that are equal to the maximum claim possible, that member can not receive any re-imbursement.

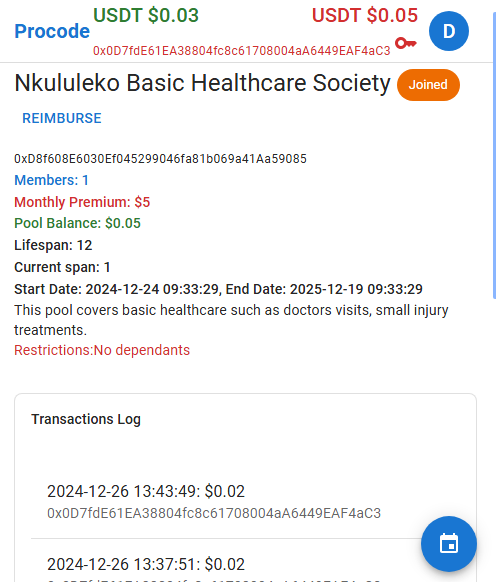

Role of Procode

Our platform Procode will act as a central directory where people will be able to access all available CBHI smart contracts deployed on various blockchain networks. Users can be able to join CBHIs that address their healthcare needs and pay premiums to those smart contracts with the help of our platform. Procode will also act as a blockchain oracle or third-party verifier, rendering our support to some CBHIs in an effort to maintain the financial wellbeing of those CBHIs. Users will also be able to deposit their fiat currencies ,which will be converted to equivalent ERC-20 crypto tokens, so that they can make their contributions. You can join our waitlist now to get benefits when we launch.

Conclusion

The Community-Based Health Insurance smart contracts will have the ability to pool together money contributed by different members. The pool should be able to process claims, reject fraudulent claims and manage the wellbeing of the pool using various mechanisms described in the article. The use of third-party (blockchain oracles) verifiers and validators will also add to the security of the CBHI described in this article. Users will also be able to access CBHIs and make contributions with the help of our platform Procode which we are launching soon.

No responses yet